Portfolio diversification is the practice of spreading your investments around so that your exposure to any one type of asset class is limited. This practice is designed to help limit risk to your investments and reduce the volatility of your portfolio over time.

As noted in a recent report by Vanguard, one of the keys to successful investing is learning how to balance your comfort level with risk against your time horizon. Invest your retirement nest egg too conservatively at a young age, and you run the risk that the growth rate of your investments won’t keep pace with inflation.

Conversely, if you invest too aggressively when you’re older, you could leave your savings exposed to market volatility, which could erode the value of your assets at an age when you have fewer opportunities to recoup your losses. True diversification is more than just a balance of traditional investments like cash, mutual funds, or stocks. There’s a spectrum of alternative investments out there that may suit your risk profile and are worth investigation. This diversification can help mitigate the risk and volatility in your portfolio, potentially reducing the number and severity of ups and downs. Diversification does not ensure a profit or guarantee against loss, but it can help.

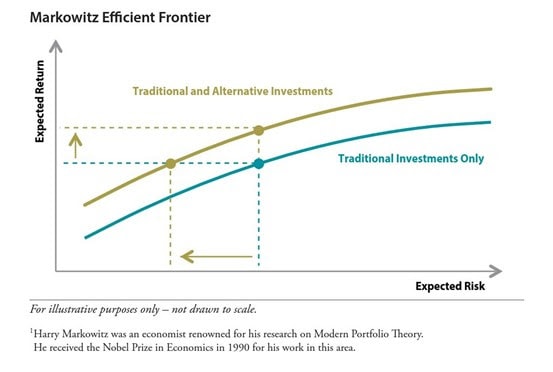

The concept of diversification is further detailed via a practice called Modern Portfolio Theory. This concept is a popular investment strategy that helps investors be risk adverse, working to find the ideal balance of risk and diversification for corresponding investment objectives. Introduced by economist Harry Markowitz in the 1950’s, Modern Portfolio Theory offers investors a mathematical framework to select the right mix of assets. In part, the concept believes that as long as assets have a low correlation to each other, your portfolio could experience reduced volatility, as those assets move conversely. When you put together a portfolio of diverse assets, you may be able to avoid concentrated risk and potentially follow the market momentum upward over time.

Despite unique risks and considerations, alternative investments can be useful tools to improve the risk-return characteristics of an investment portfolio. They can increase diversification and reduce volatility, given low correlations to more traditional investments, and they can offer the potential for enhanced returns due to the wider investment opportunity set.