How Mortar Differs from Other Real Estate Firms

A Boutique Approach to Building Value

Most real estate investment firms are built for scale — optimizing for assets under management, fee income, and institutional growth. Mortar was built a little differently. We’re a boutique, design-driven investment and development firm that merges architecture, construction, and capital under one roof.

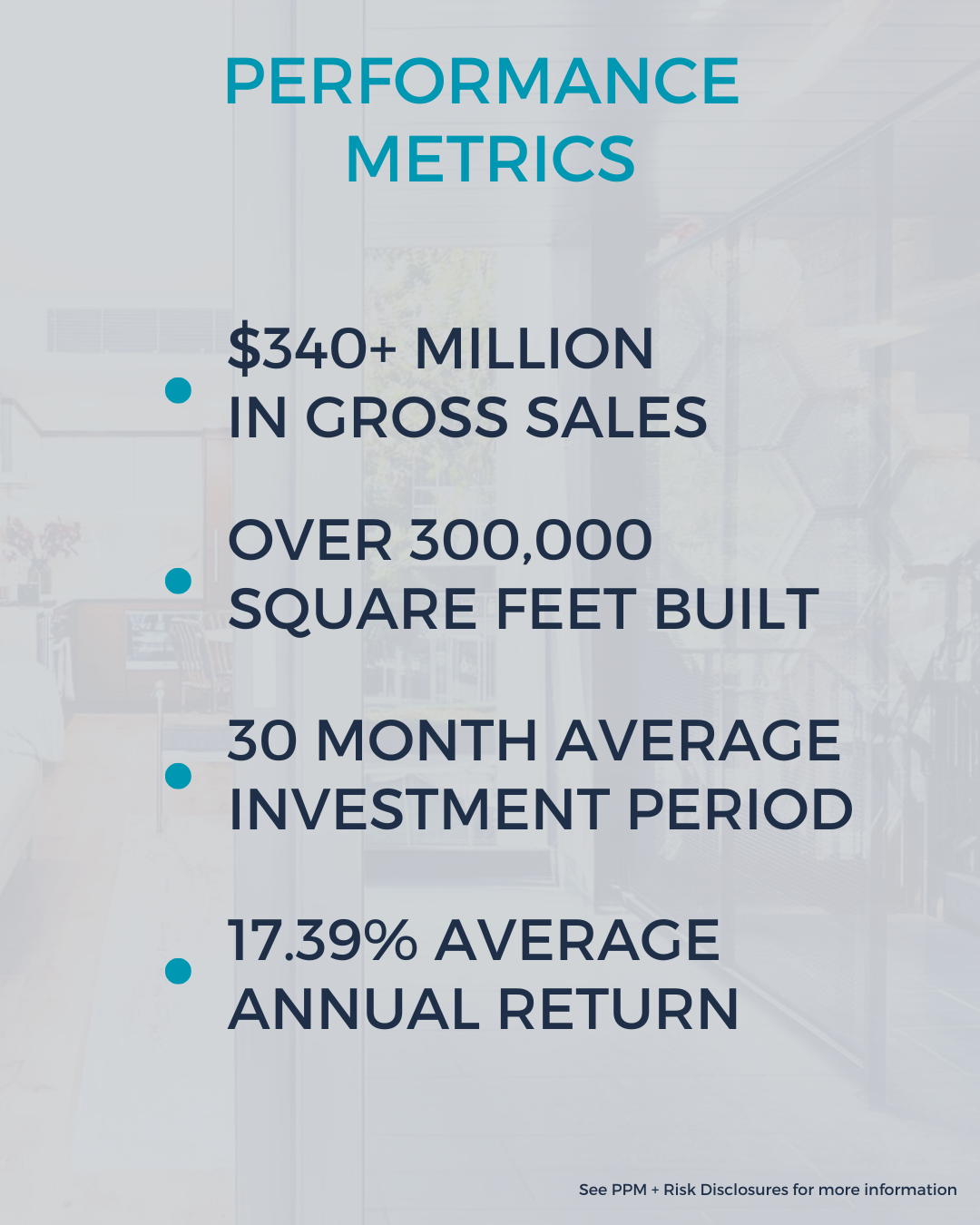

Since 2001, Mortar has tackled more than 40 projects across New York City, delivering consistent returns and lasting value for our investors.

“Our goal isn’t to be the biggest — it’s to be the most disciplined, design-focused, and trusted partner our investors have.” Anthony Morena – Principal, Mortar Group

Shared Investment Philosophy — Not Fee Structures

Large funds and investment firms typically charge annual asset management fees, where AUM becomes the goal and funds collect income regardless of how projects perform. That model rewards scale — not results.

Mortar operates differently.

We don’t charge annual asset-management fees on investor capital. Our compensation comes only through the project development and successful execution ensuring investor outcomes drive our own.

Projects includes substantial sponsor equity from Mortar’s principal, meaning our capital is always invested right beside yours. That shared philosophy creates genuine accountability and focus.

Boutique Service, Institutional Rigor

Most large firms communicate through layers of management and investor-relations staff. Mortar takes a different approach.

We provide personal, boutique-level service — investors have direct access to the principals leading each project. Every update and report comes from the same people driving acquisition, design, and execution.

Behind that personal experience lies institutional precision.

Our in-house teams manage architecture, development, construction, property management, and investor relations, giving us control over cost, quality, and timelines that outsourced models can’t replicate.

We combine the sophistication of a private-equity firm with the care and craftsmanship of a design studio.

Selectivity Over Scale

While larger firms pursue dozens of deals each year to grow AUM, Mortar is intentionally selective. We evaluate hundreds of opportunities but only advance those that meet our strict design, financial, and execution standards. Our underwriting focuses on downside protection first, testing every assumption across rate, rent, and cost scenarios.

We only build what we believe in – and where we believe a project can be successful.

Partnership, Not Platform

When you invest with Mortar, you’re not joining a fund or participating in a platform — you’re partnering directly with the developer.

We manage every phase internally and communicate transparently throughout each project lifecycle.

Our Investors Benefit From:

- No annual asset-management fees — more of your capital stays invested

- Direct principal access — clear communication, no layers

- Design-led execution — value created through architecture

- Conservative structuring — no speculative leverage or cross-collateralization

Real Estate Is Real — and So Are the Risks

Real estate, by its nature, involves risk. Markets shift, costs fluctuate, and not every project unfolds exactly as planned.

If you’ve been building and investing as long as we have, you’ve experienced both — the projects that exceed expectations and the ones that teach lasting lessons.

What matters most is how those moments are managed.

With more than two decades of experience, in-house control, and disciplined financial oversight, Mortar has navigated every market cycle with consistency.

Experience doesn’t eliminate risk — it manages it, anticipates it, and learns from it

That experience gives our investors’ confidence that when conditions change, they’re backed by a team that has lived through — and succeeded through — every kind of market.

The Mortar Difference

Our size is our strength.

It allows us to stay selective, stay disciplined, and deliver better value to our investors.

By eliminating unnecessary management fees, maintaining a lean structure, and investing alongside our partners, Mortar aligns design excellence with financial performance — every time.